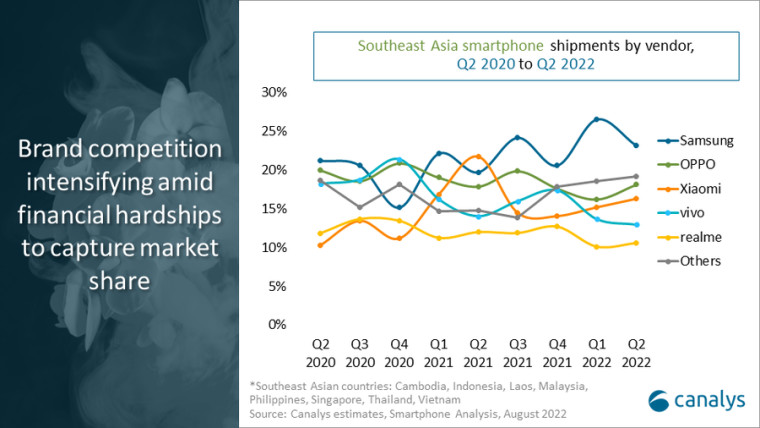

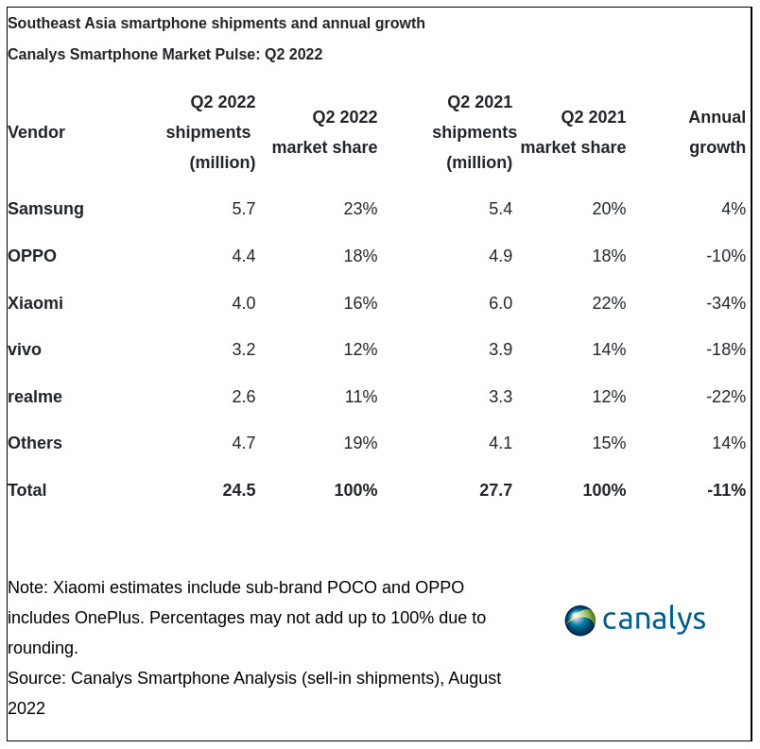

Canalys has released data about the smartphone market in Southeast Asia. The biggest loser in Q2 year-over-year was Xiaomi, who saw a large 34% decrease in shipments. It was followed by realme (-22%) and vivo (-18%), but Samsung did best as it increased its shipments by 4%.

Since the fourth quarter last year, smartphone shipments in SE Asia have fallen by 12% in the first quarter and now another 7% in the second quarter. Much like the rest of the world, nations in the region have also been hit by macroeconomic pressures such as energy shortages and inflation. They are all still recovering from the COVID-19 pandemic, too. Canalys took its data from Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, and Vietnam – missing from this data are Brunei, Myanmar, and Timor-Leste.

Discussing the smartphone market outlook for the region, Canalys Research Analyst Chiew Le Xuan, said:

“The demand for 5G devices has come to a standstill. 5G devices experienced their first sequential decline to 18% of overall smartphone shipments. 5G deployment in developing Southeast Asian markets has been abysmal ensuring the hype for 5G has dwindled, and demand has shifted to more practical aspects of smartphones such as battery life, storage, processor speed, and camera quality. Growing inflation has resulted in consumers looking for longer-lasting devices over less practical qualities such as 5G. Practical uses of 5G have yet to be seen, and is especially unnecessary for low-mid devices when 4G speeds are sufficient in day-to-day usage.”

The top brands in the surveyed countries were Samsung, OPPO, Xiaomi, vivo, and realme. Each of their year-over-year performances can be seen below:

Last month, Canalys reported that customers worldwide were looking away from mid-range phones to low-end phones as budgets get squeezed. The same is true for SE Asia, where customers are shifting away from mid-high-end devices as they cut back on spending.

Apple is bucking the trend in the premium price segment, where the popularity of the iPhone 13 and the launch of the iPhone SE is helping it to maintain its position. Canalys said Apple customers in the region tend to be richer and inflation has had less of an impact on their budgets, so they can continue to buy Apple products.

3 Comments - Add comment