When it comes to multinational corporations and paying taxes, things can get quite confusing for the average person. Apple hasn't been a stranger to the controversy surrounding companies using the tax laws of many smaller nations to subvert its responsibility. The Paradise Papers revealed even more of the murky dealings by the world's largest corporation, helping it pay a mere 3.7% in corporate taxes in 2017 - which is a fraction of the worldwide average.

In the leaked documents, it detailed how Apple attempted to find different avenues at securing its worldwide profits, which accounted for roughly 55% of its total income in 2017. This followed the Irish crackdown on companies like Microsoft and Apple, of which used the 'Double-Irish' tax loophole. Tim Cook famously defended these business decisions in the U.S. Senate, saying that the company he headed 'paid every dollar it owed in income tax', and didn't "stash money on some Caribbean island".

However, Apple sent a questionnaire to Appleby's, inquiring about the tax laws and financial regulations of countries like Jersey and Guernsey, the Cayman Islands, and others. This would allow the company - after choosing which country offered the best 'tax haven' - to change the 'tax residency' of Apple Sales International (ASI) and Apple Operations International (AOI) to the particular country without effectively moving all of its operations to the said nation. This would then negate the need to pay corporation tax in any country worldwide - barring any sales taxes.

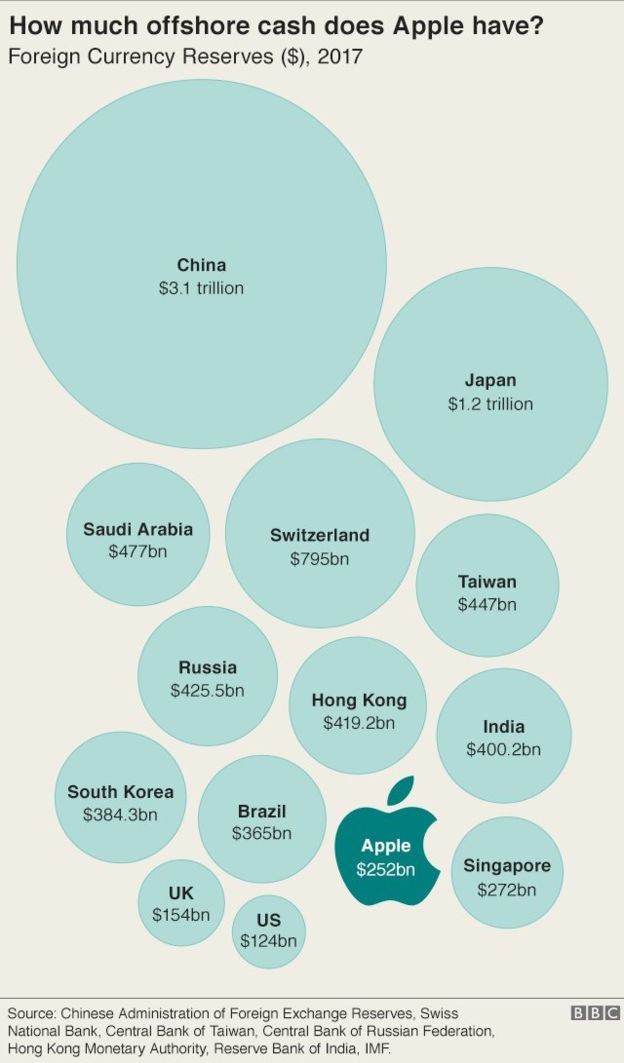

In its last financial report, Apple noted that it made $44.7 billion outside of the U.S., and paid only $1.65 billion in taxes. Moreover, the company currently sits on a $252 billion mountain of cash, which is mostly stored in international tax havens. This cash hoard, incidentally, is managed by ASI and AOI in the Channel island nation of Jersey. One can be forgiven to believe that this surely contradicts the earlier statement by Tim Cook since Jersey is certainly an island - however, to be fair, it's not a Carribean island.

In August of 2016, Apple was ordered by the European Commission to pay €13 billion in taxes, which Tim Cook called 'total political crap' at the time. The company has moved to appeal the decision of course, and the EU has decided last month that it would take Ireland to court for failing to collect on these taxes. The Irish government has shut down the 'Double-Irish' tax loophole, however, in the same move, created new regulations that companies like Apple could take advantage of. One of these have been the 'Cost of intangible assets' deductible, which allows a company to move its intellectual property to Ireland, and instead of paying taxes on the future profits of said assets, claim so-called 'costs' against this income.

In 2015, this resulted in a GDP spike of 26% for the country. According to reports, intangible assets in Ireland rose by a gigantic €250 billion during that year, giving way to speculation that Apple has taken advantage of this new loophole. The Department of Finance denied at the time that its new regulations resulted in multinationals benefiting unfairly, noting that these regulations were 'not unique in allowing companies to claim capital allowances against intangible assets'.

The 13.4 million records from the law firm Appleby's were leaked earlier this month, which includes information on the dealings of corporations, celebrities, and politicians among others. These were sent to the German newspaper Sueddeutsche Zeitung and subsequently distributed to other media outlets. As with the BBC, Neowin does not know the identity of the source.

Source and image: BBC

_small.jpg)

46 Comments - Add comment